In a livestream webinar hosted by 4thly Accelerator’s Bret Waters, Foley partners Louis Lehot and Julie-Anne Lutfi shared data and war stories about the state of the venture capital market in the fourth quarter of 2023. While deal flow and deal count continue to see declines, speakers shared optimism about the amount of dry powder still waiting to be deployed at historically attractive valuations and deal terms.

Capital Investment

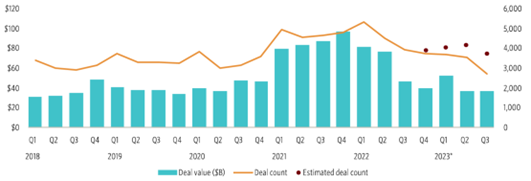

U.S. Venture funding quarterly deal value falls to the lowest figure since Q2 2018

PitchBook-NVCA Venture Monitor as of September 30, 2023.

The group is optimistic about:

- Historical amounts of dry powder in both Venture Capital and Private Equity funds that could be deployed in the next 12-24 months.

- Lower valuations should incent funds to deploy capital at historically good prices on best-in-a-decade terms

- Opportunities for non-Silicon Valley technology clusters in the United States like Atlanta, Austin, Boston, Dallas, Denver, Houston, Los Angeles, Madison, Miami, Nashville, New York, Salt Lake City, San Diego, Tampa, and beyond, and technology clusters that are blossoming in Singapore, Kuala Lumpur, Jakarta, Seoul, Stockholm, Paris, Berlin, Dublin, London and even Latin American hubs Sao Paolo, Rio de Janeiro, Mexico City, Guadalajara, Santiago, Bogota, and Lima.

Trends that the group discussed included:

- A renewed focus on corporate governance for startups in the wake of failures at FTX and a failed experiment at OpenAI.

- SAFEs continue to be the ubiquitous form of early-stage financing from coast to coast, with extensions, SAFEs, and convertible notes increasingly being used to bridge financings between equity rounds.

- A move away from “Factory-Farmed Unicorns” where investors would drive up valuations regardless of profitability.

- Venture fundings being announced that are really acqui-hires of companies with revenue, talent, and money in the bank.

- Traditional mergers and acquisitions continue to be few and far between given the government’s posture against “big tech” acquirers and the prevailing interest rate environment, which make the expectations gap between buyers and sellers a chasm.

Outlook for venture capital:

- Stabilizing interest rates should lure investors to come back to the table.

- Failure rates are likely to increase in 2024 before leveling out, and more portfolio mark-downs are likely to come.

- Maturation in generative artificial intelligence technology should yield benefits to all.

- Climate technology continues to advance by leaps and bounds.

It was an excellent opportunity to hear from the group who have insights into both coasts and are plugged into the venture capital landscape.